Identity verification is one of the hottest usecases for the blockchain. I already wrote on this topic few months ago with the idea of a fictive government binding hashed identity data to citizen’s ethereum address.

Recently, I ran into ShoCard, a mobile app which is able to locally store user’s identities (driver’s license, passport, tickets, credits cards, online accounts, …) on the mobile phone and seal this data by putting the hashes via the BlockCypher API on the blockchain. Furthermore, institutions, like banks for instance, can verify user’s identities and store this fact on blockchain too, effectively confirming that the sealed id record is correct.

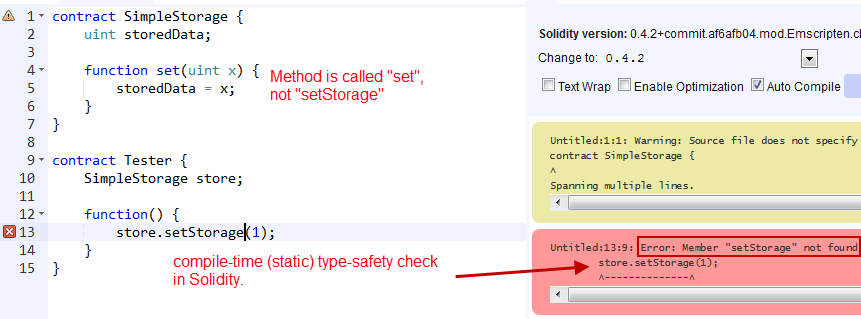

I did the experiment of implementing ShoCard’s concept on the Ethereum blockchain. A very interesting point is that we only need one simple contract for the implementation of the concept. It simply binds a hash value to an address:

contract DataSeal {

address owner;

uint256 dataHash;

function DataSeal(uint256 _dataHash) {

owner = msg.sender;

dataHash = _dataHash;

}

}

First, for every user’s identity record of the form

idRecord = {idData_1, ..., idData_n, randomValue}

we create in Ethereum a DataSeal instance storing idRecord‘s hash value.

idRecordSeal = new DataSeal(<idRecord hash>)

From now on, idRecord can not be modified without breaking idRecordSeal.

If we want to prove to X that our idRecord has been sealed by us, we will send to X the idRecordSeal address and idRecord signed with the private key of the Ethereum account used to instantiate idRecordSeal. Having this informaton, X can verify that idRecord matches the hash value in idRecordSeal contract and that the signature matches its owner.

So far, we have the proof that idRecord was created and sealed by us, but we have no proof yet that idRecord matches our real identity as documented on our id card. For instance, we could steal the id card from someone else and seal it on the blockchain. In order to make the idRecord trustworthy, we need a trustworthy witness verifying our idRecord and committing the proof to the blockchain.

The most direct witness for this proof would be the public authority issuing the id cards to the citizens. The next best instance, could be a commonly accepted institution like the mailing company (see POSTIDENT solution of Deutsche Post AG) or a bank.

If the user has been successfully authenticated, the witness will produce

witnessRecord = {idRecordSeal, secretKey}

and create a new instance of the DataSeal contract with the hash of it:

witnessRecordSeal = new DataSeal(<witnessRecord hash>)

Finally the witness shares the following record with the user:

{witnessPublicAddress, witnessRecordSeal, secretKey}

Assuming that X is trusting W, and that we already were authenticated by W, we can pass to X

- the witness data {witnessPublicAddress, witnessRecordSeal, secretKey}

- our idRecord signed with the corresponding private key

- our idRecordSeal address

Now X, can check that idRecord hasn’t been modified, that we’re the owner of the record and it’s blockchain seal, and that we already were successfully authenticated by W. If X trusts W, then he doesn’t need any further verification of our identity and he can do business with us.

The concept is universal and it works with any kind of document. There are also usecases where no witness is needed at all. For instance I can seal my credit card data like this:

creditCardDataSeal = new DataSeal(<hashed credit card data>)

Every time I purchase something, I also sign my purchase with my Ethereum private key and the merchant can verify that credit card data is in my ownership. So even if someone steals my credit card, he won’t be able to purchase something with it, because the thief can not prove he’s the owner of the credit card.

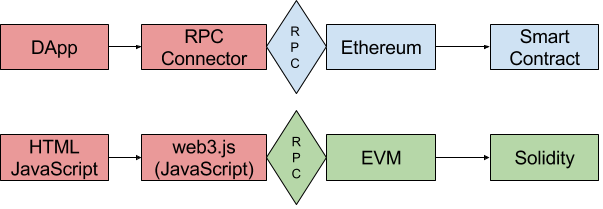

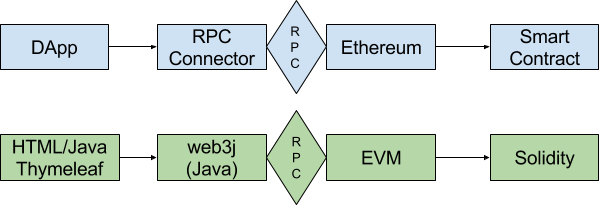

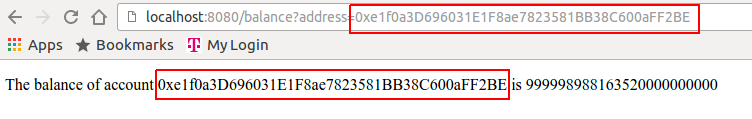

Of course, you can change the Ethereum net like you want in file EthereumController to morden or mainnet, just read the welcome mail from infura.io. Or you can just use a local Ethereum node like geth with RPC enabled (geth –rpc) and http://localhost:8545 as the constructor for HttpService of the Web3j-Factory in EthereumController.

Of course, you can change the Ethereum net like you want in file EthereumController to morden or mainnet, just read the welcome mail from infura.io. Or you can just use a local Ethereum node like geth with RPC enabled (geth –rpc) and http://localhost:8545 as the constructor for HttpService of the Web3j-Factory in EthereumController.