This is a follow-up post to Gambling with Oracles and describes the technical part for the implementation of an Oracle with oraclize.it

People told us last time that we had not really created an binary option. This might be true and to not confuse the reader and also to introduce just another cool use case and link to current events, we are going to bet on the winner of the EURO 2016 soccer championship.

As you see from the posting date, the championship is already finished and the winner is well known, it is Portugal.

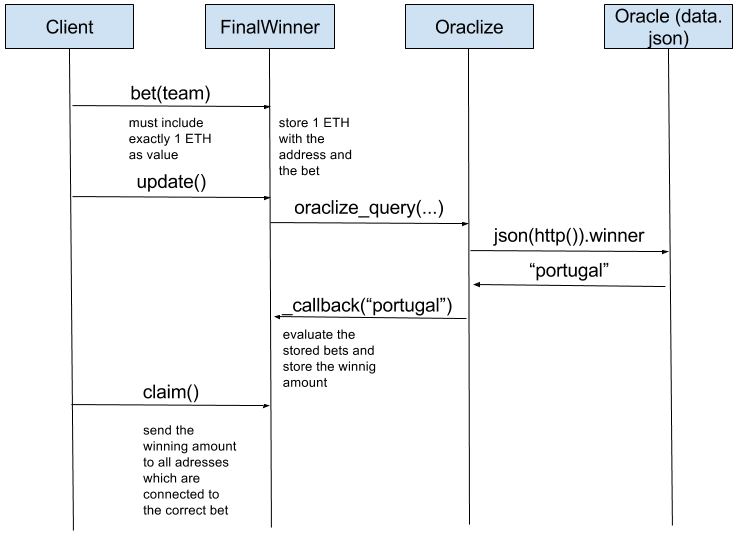

So we can just create a static Oracle to make things easier, we will define the Oracle call in our betting contract and on calling update(), the winner will be determined, which is the static json {“winner”: “portugal”}.

You can call bet(winner) with exactly 1 ETH and on calling claim() you will get nothing or (loseBets + winBets) / (numberOfParticipantsWhoBetOnWinner), eg. 3+2/2 = 2.5

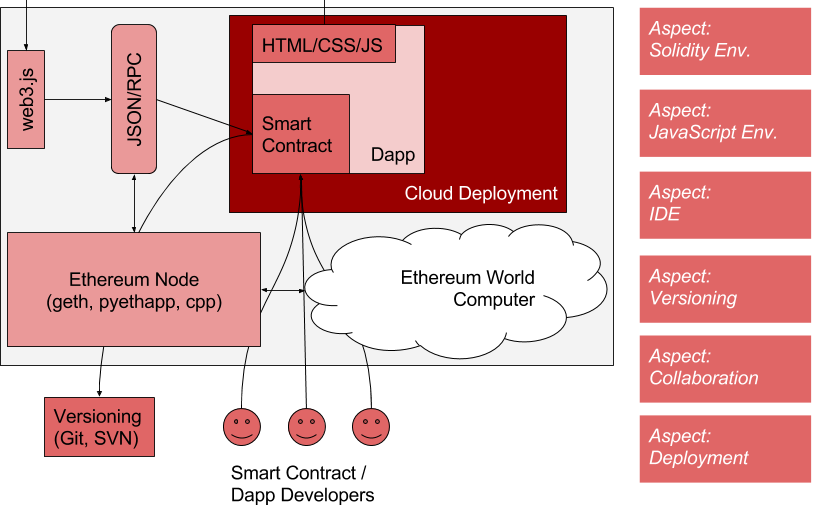

Prerequisites

You will need to sign up for the ether.camp Studio and check out the corresponding github project in the terminal, follow the instructions in the README.

Starting the Oracle

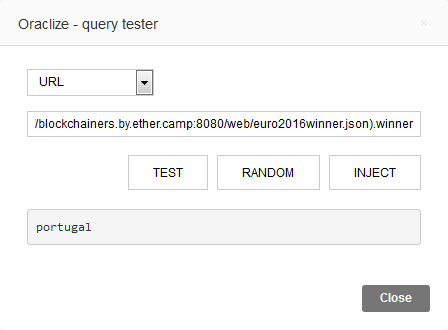

After starting the web server, you can access the “Oracle” with https://yourid.by.ether.camp:8080/web/euro2016winner.json which redirects to the file web/eu2016winner.json in your project.

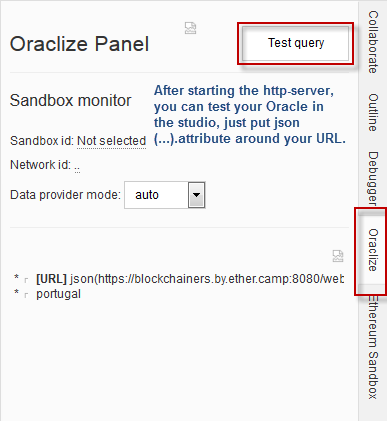

You can test the data retrieval in the Studio, just choose the Oraclize tab, Test query, “URL” and put json(…).winner around the URL.

That’s it, by clicking “Test” you should get the result “portugal”. So now the Oracle Smart Contract can call your Oracle datasource and submit the result via callback to your contract.

Obviously, a real Oracle should be a little more dynamic, but for testing purposes this Oracle is enough. You can change the answer by stopping the web server, changing the file manually and restarting the server.

Obviously, a real Oracle should be a little more dynamic, but for testing purposes this Oracle is enough. You can change the answer by stopping the web server, changing the file manually and restarting the server.

To avoid duplicating information here, please consult the documentation for the ether.camp Studio IDE for actual usage of the sandbox. Remember to give enough value (at least 0.1 Ether in Wei: 100000000000000000) for the update() call, but also 1 Ether in Wei (1000000000000000000) for the bet()-calls, otherwise it will not work.

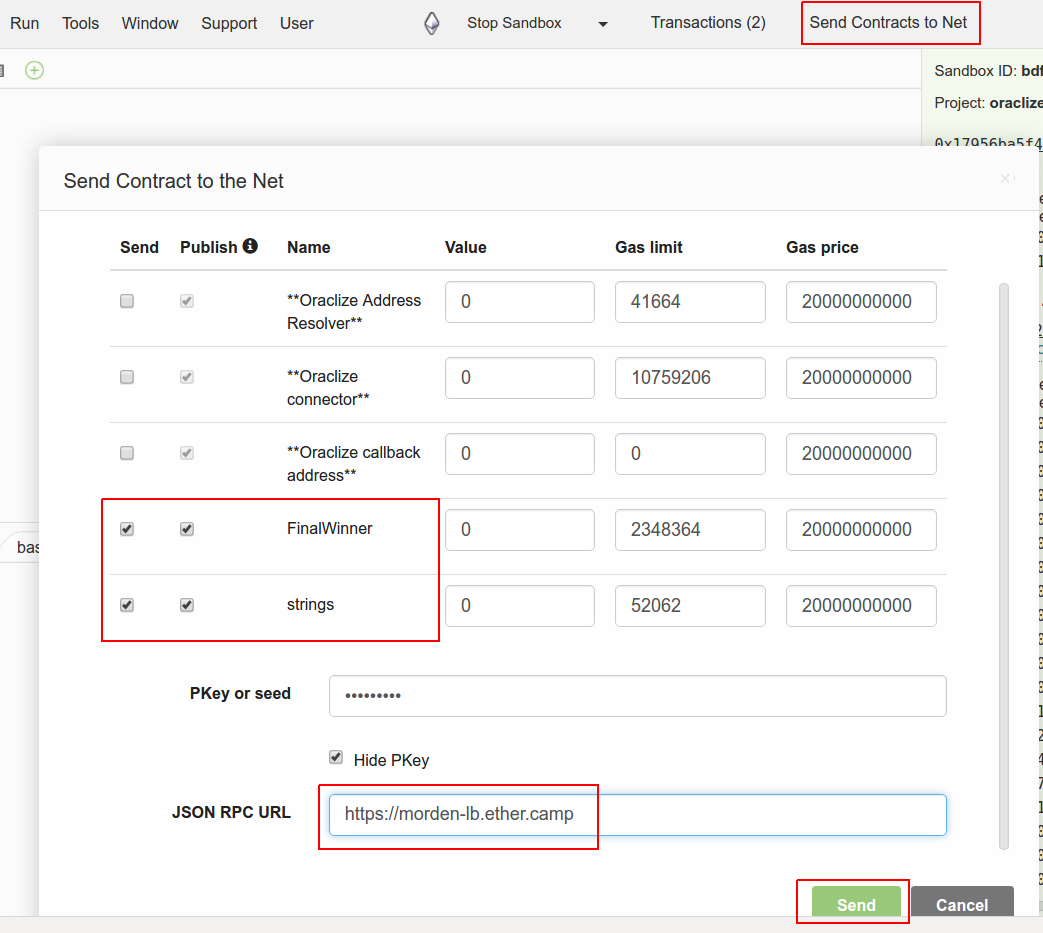

Deploying the betting contract to Morden

The contract.sol contains the complete contract, it imports some helper classes and the oraclize-API, which, depending on the deployed environment, is instantiated with the corresponding contract address.

In the README you will see the local environment sample, but also the Morden example. To deploy the contract to the testnet Morden, you will have to get Ether first, which is really simple in Morden.

Note: you have to set the networkID to Morden in the constructor of the contract before deploying:

function FinalWinner() {

oraclize_setNetwork(networkID_morden);

}

After deploying, you can click on the Transaction-Hash in the Transaction-Tab, which automatically opens the deployed contract in morden.ether.camp.

To be able to invoke the contract in ether.camp, you will have to upload the sources of the contract, however, there is a problem with inline assembly at the time of writing this post. Therefore we added a special file (for-upload-to-ether-camp-morden-as-source-only.sol-not.executable) for uploading in the root of the github-project, this contract is just for this purpose and is not executable.

In Morden, each call should be done with value 1 Ether, the bet-calls will throw; otherwise and the update call needs some for the call of Oraclize, which costs Ether for each call (consult pricing on oraclize.it).

![[casino kurhaus*]](http://blockchainers.org/wp-content/uploads/2016/06/16135779895_fdea2ef33c_z-e1465673411204.jpg)

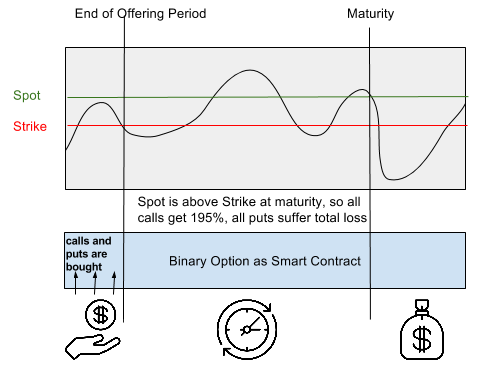

So, in contrast to common regulated financial products we have a really comprehensible option, which is mostly valued as high-risk, because there is a real clash of interests if the broker also evaluates the stock against the strike price and thus is highly motivated to manipulate this evaluation.

So, in contrast to common regulated financial products we have a really comprehensible option, which is mostly valued as high-risk, because there is a real clash of interests if the broker also evaluates the stock against the strike price and thus is highly motivated to manipulate this evaluation.![[oracle*]](http://blockchainers.org/wp-content/uploads/2016/06/5822220225_0af0d40df4_m.jpg)

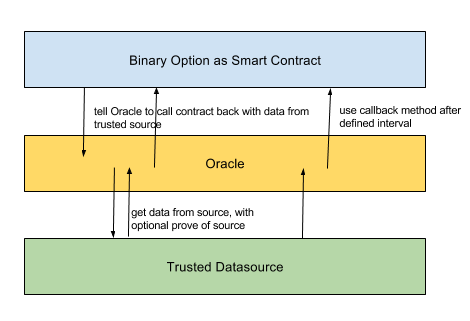

Here the two problems are addressed:

Here the two problems are addressed: