This post is inspired by the book with the same title, which we found in in this nice summary post by Alex Preukschat. In that blog post and especially in the book you will find all information about Self-Sovereign Identity. We will only refer to the concepts if they are feasible for our samples.

This is not a Blockchain-bullshit-only post. Head to https://github.com/ice09/identity for a sample implementation of the “federated” claim issuer sample.

The Story of Alice, Booze and her local Bank

Alice just turned 18 years old, being in good ol’ Germany she wants to celebrate this with a lot of booze, but her parents refused to buy it for her, since she can do this on her own now.

Currently, she can do this easily by showing her identity card when buying the drinks. The dealer would check her birthdate and verify her age.

This obviously has major shortcomings:

- The ID could easily be altered, stolen or otherwise not belonging to the person showing it

- The dealer gets a lot more information than necessary for this transaction, including a lot of sensitive personal data: name, address, height, etc.

So, the dealer would just have to verify that the person is older than 18 years, how could this work with Alice and eg. her local bank?

The book differentiates between identity and statements about this identity (claims), which entitle the person to do things. In our example, the fact that Alice turned 18 years old entitles her to buy and drink alcohol (in certain legislations). However, showing the identity card to the dealer mixes up two aspects very badly: the dealer has to check the identity information to derive the entitlement. This he has to do by himself, if for whatever reason (eg. the dealer not being able to calculate the age) he cannot derive the entitlement, Alice’s intention would be rejected. Also, only information which can be derived from the identity information can be used, if eg. Alice would be incapacitated and therefore not allowed to buy alcohol, the dealer wouldn’t know, since this information is not stated on her identity card.

In the world of cryptography and decentralized data storage (read: DLT), Alice’s bank could easily help her with an identity or better: entitlement verification service. Since Alice participated at the bank’s KYC process, the bank has a lot of information about Alice, one of these being her age. Now, if the local bank is trusted by the shop owner, this information would be enough for the owner: “As your local trusted bank, we verify that this customer is older than 18 years.”

Setup for Ethereum

In Ethereum, the easiest setup would be to use ERC 725/735. These standards (requests) provide all necessary equipment for identity creation and claims/endorse mechanism. Other standards and products are provided by uPort and standard bodies like the W3C DID.

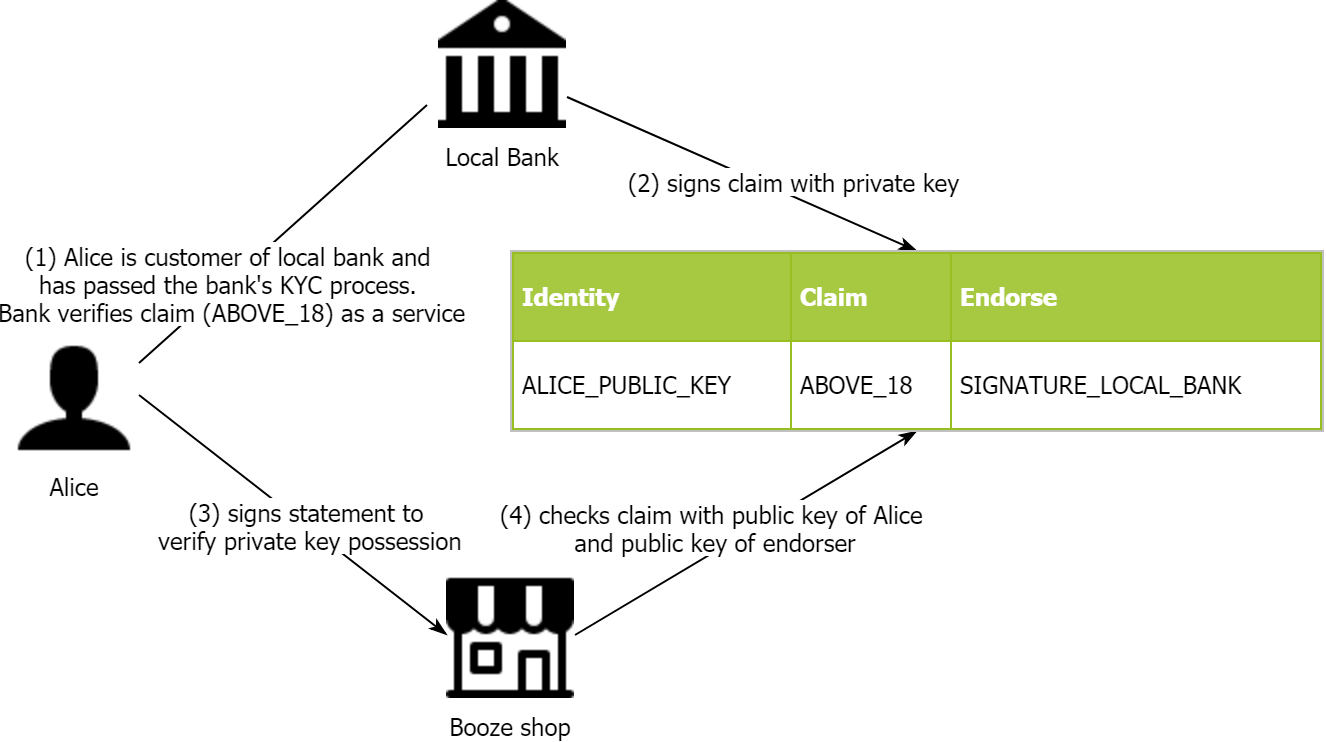

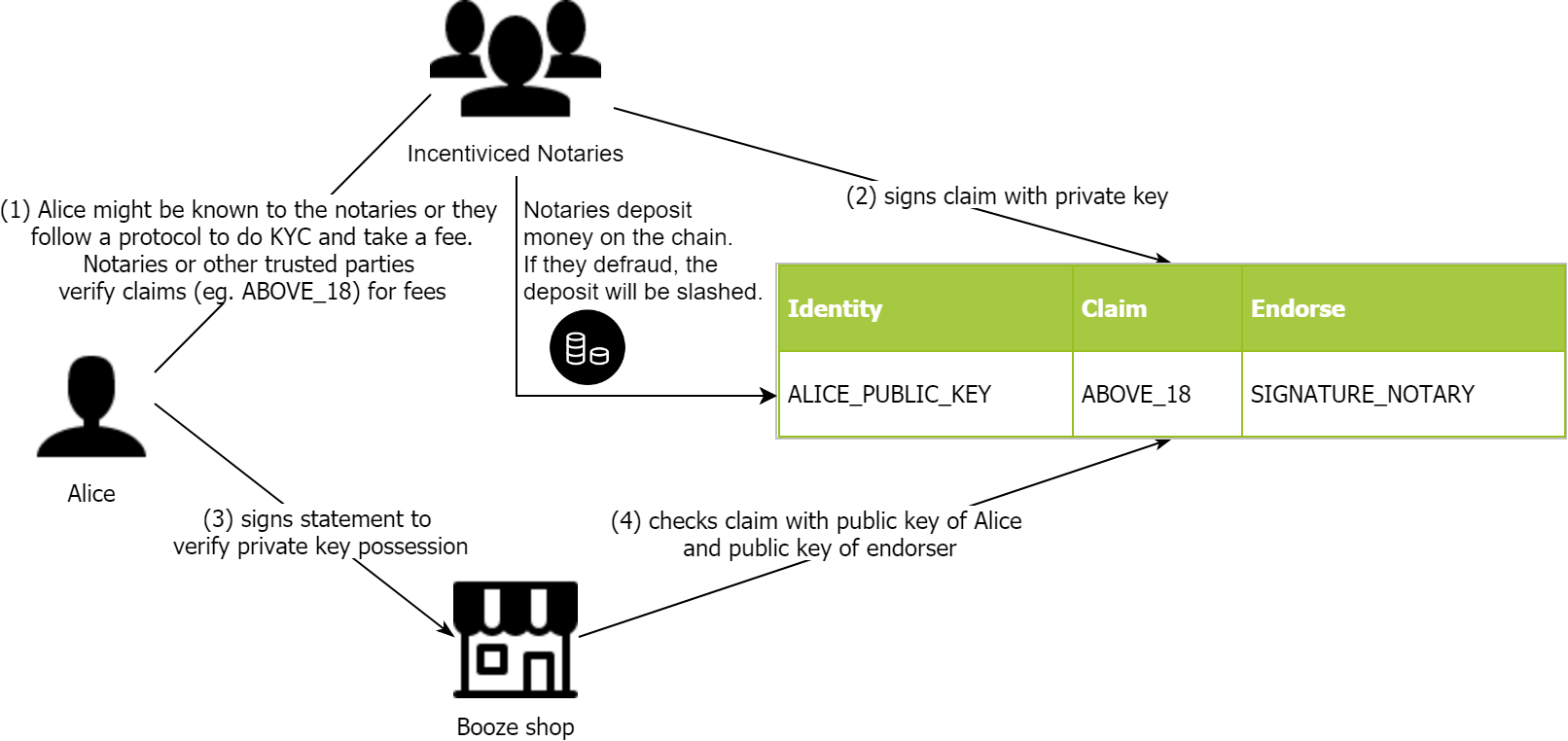

The initial setup Alice has to execute, together with the claim issuers like the bank, a utility provider, an insurance company, etc. consists mainly of three steps which could easily be embedded into a mobile app:

- Alice creates an identity ERC 725/735 (which might be one of multiple identities she has)

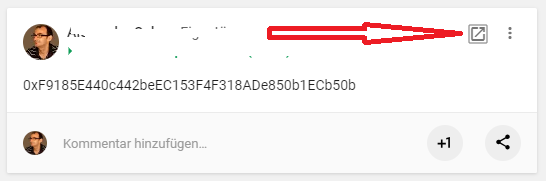

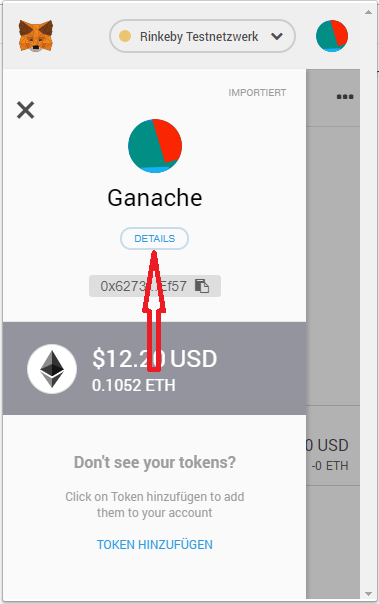

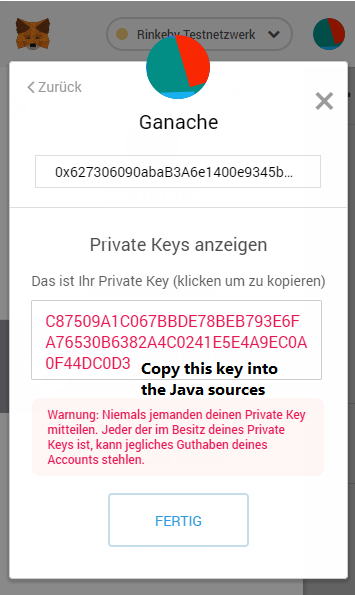

- As a claim issuer, the bank adds a claim (using ERC 735 addClaim(…)) about Alice being older than 18 years. This claim is signed by the private key of the bank. The claim is stored with a returned ID and must be approved by Alice (1, 2).

- Alice approves (using ERC 725 approve(claimId)) the bank’s claim on her identity.

- Now, anyone can verify the claim about the topic she is interested in, eg. the fact that the identity is older than 18 years (4).

After the setup the process of verifying a claim is depicted below:

- Alice signs a challenge of the shop owner with her private key (3).

- With the derived public key of Alice, the shop owner can identify the claim in ERC 735 and check the signature of the trusted party, which is Alice’s bank (4), against the publicly available public key of the bank.

This would make a great use case for banks desperately looking for their next Blockchain use case: forget about value transfer, asset creation, settlement and whatnot, you are fighting against proven and established systems which might be embedded in complex processes but have been running stable, reliable and performant for years.

Identity verification on the contrary could be a completely new service offering and banks have the great advantage of having identified thousands of customers in strongly regulated processes, they have valuable data at their hand. The same is true for insurances, mobile providers, utility providers, governmental companies, etc.

But let’s say we want to decentralize even more, how could we go on?

Incentivizing Identity Verification

Couldn’t we incentivize people for doing something only they are able to do right: prove the identities of their social network?

There are some assumptions:

- People know their social environment best, especially their direct environment like family, best friends and neighbors.

- People want to earn (even few) money with something they – and only they – can do easily following a simple procedure

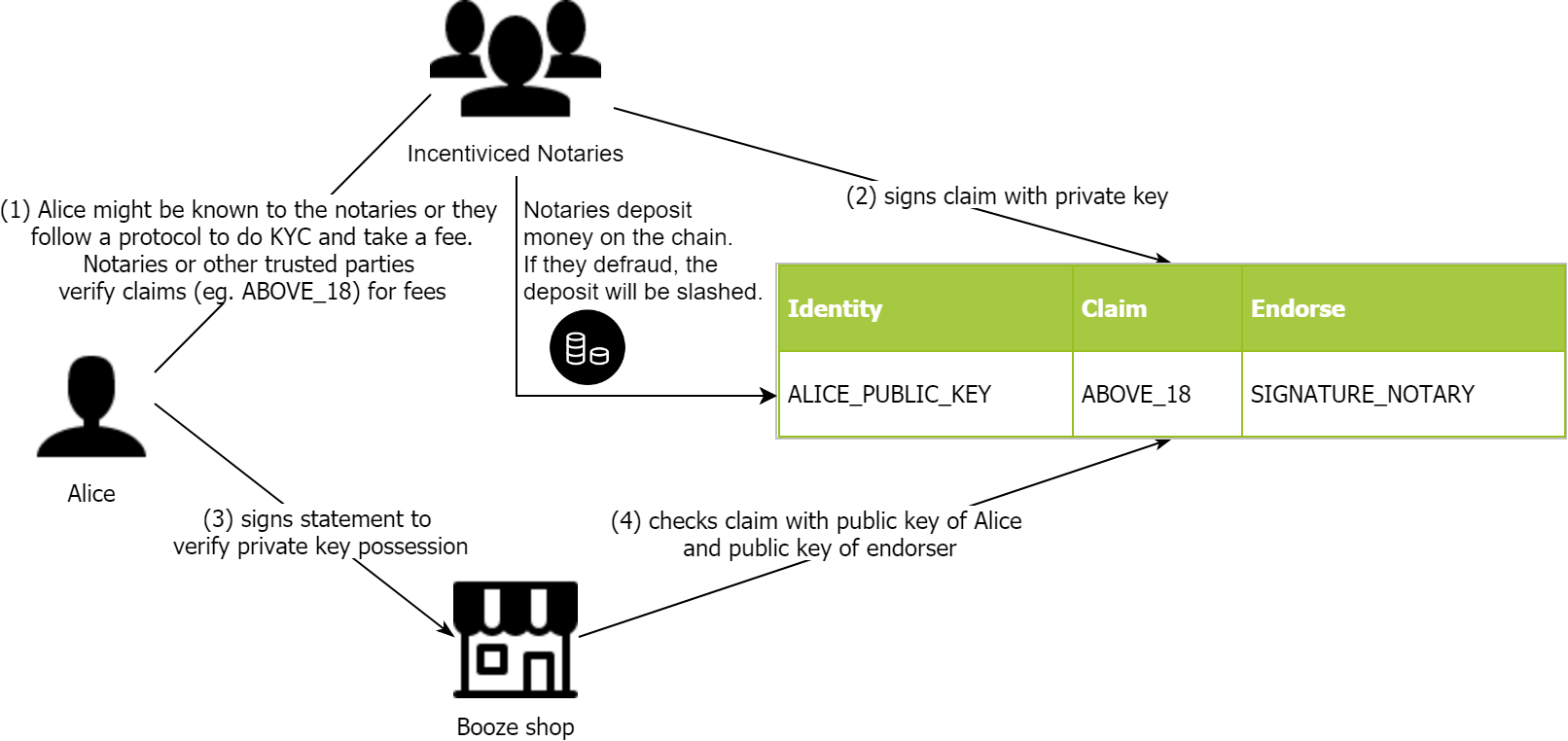

The process is almost equal to the process above, except that notaries are slashed if they defraud and earn fees if they behave according to the protocol. The slashing is complex and would have to be implemented by some governance mechanism. This step adds complexity, but is solvable and will be very similar to PoS. Most likely there will be a incentivization for detecting and proving fraud included into the protocol.

Incentivization is a great means for getting anonymous parties to agree on a fact. This works great for Blockchains and has also been proven theoretically by eg. game theory and the Nash equilibrium.

Therefore, with incentivization of notaries, their advantage of doing fraud is minimized.

Build a Social Network based on Trust

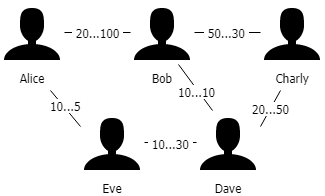

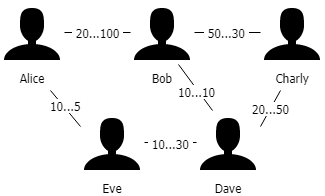

Trustlines is a decentralized, permissionless, open platform to host currency networks in which money is represented as IOUs issued by its participants. Trustlines implements money as bilateral peer-to-peer issued blockchain-based credit.

In the example above Bob gave Alice a creditline of 20 EUR and Alice Bob of 100 EUR, so they have bilateral creditlines which is a trustline. Bob gave Charly 30 EUR credit and Charly Bob 50 EUR. Now if Alice wants to pay Charly, whom she doesn’t know personally, the system finds a path between Alice and Charly (via Bob) and the creditlines will be used. If Alice pays Charly 10 EUR, Bob afterwards owes Charly 10 EUR and Alice owes Bob 10 EUR. The creditlines have been used and the remaining credit is lower or higher, depending on the direction of the payment.

There is no settlement in the system, if it is necessary or wanted by some party to settle, this is done outside of the system and then reflected in the system by an opposite transaction.

More information about the project is available on trustlines.network, we encourage you to inform yourself about its concepts of people powered money and complementary currencies and its potential to boost cryptocurrencies adoption and enhance accessibility for cryptocurrencies for all people.

Extra Trustlines Benefit: Socially proven Identity

However, for this blog post, a secondary aspect of Trustlines is more important: if you have a social network of trust, you have a social network of identities. This is immediately obvious by the simple fact that if you trust someone with a certain amount of money, you certainly know and trust this person, because you are in risk of losing money if your creditline is used. Depending on the social context this can be family members, good friends, co-workers and the amount of credit you give will mirror your amount of trust in these people.

Given a network with creditlines, people will most likely have creditlines with different people and a identity (and reputation) algorithm could value the amount of credit given and the number of creditlines for a probabilistic identity verification.

This might even be pseudonymous, as someone offering a service for money, I am most interested in a receiver to pay me money, which is related to his trustworthyness and therefore to the amount of creditlines given, not so much who this person actually is. If 10 people who have medium sized networks of creditlines have creditlines with the receiver, I am tending to assume that:

- This person actually exists

- This person is trustworthy for some amount to other people

For now, this is the only attribute of identity which Trustlines helps solving, but with very high accuracy: if a person actually exists and that this person is trustworthy to some degree.

We won’t have information about other identity attributes like gender, age, wealth, educational degrees and so on.

Let’s fix Identity now!

If you didn’t know a good use case for Blockchain technology, now you have it. This is one of the most natural use cases for a decentral, immutable database accessible by everyone without central control and the possibility to incentivize people.

This is a win for all involved parties, enhancing privacy and security and enabling service providers to make use of their already available data. As there is no “disruption” of any existing business model, but a creation of a completely new one, public identity management can only get better.